18 July 2025

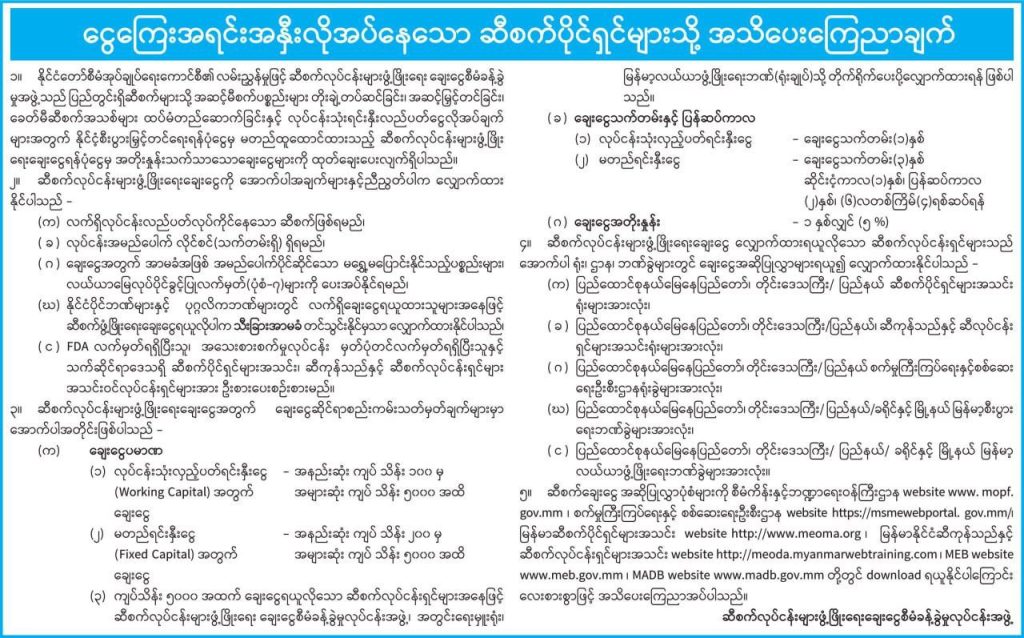

The Oil Mill Development Fund is offering loans ranging from 10 million to 500 million kyats at an interest rate of 5 percent. If additional funding is necessary, loans exceeding 500 million kyats may also be available. This announcement was made by the Oil Mill Development Loan Management Group for oil mill entrepreneurs seeking capital.

Under the guidance of the State Administration Council, the Oil Mill Development Loan Management Group is providing low-interest loans from the Oil Mill Development Loan Fund, which was established by the National Economic Development Fund. These loans are aimed at supporting local oil mills in expanding operations, installing advanced equipment, and constructing new modern facilities, as well as addressing business capital needs.

To apply for an oil mill development loan, entrepreneurs must currently operate an oil mill, possess a valid business license, and provide certificates of real estate and farmland ownership (Form-7) as collateral.

Additionally, entrepreneurs with existing loans from state-owned or private banks who wish to apply for an oil mill development loan must submit a separate guarantee. Priority will be given to applicants who have obtained an FDA certificate, a small industry registration certificate, and members of the Oil Mill Owners Association, Oil Merchants, and Oil Mill Entrepreneurs Association in their respective regions.

The loan amounts available are as follows: for working capital loans, the minimum is 10 million kyats, and the maximum is 500 million kyats. For fixed capital loans, the minimum is 20 million kyats, also with a maximum limit of 500 million kyats. Oil mill entrepreneurs seeking loans exceeding 500 million kyats should apply directly to the Oil Mill Development Loan Management Team at the Secretariat of the Myanmar Agricultural Development Bank (Head Office).

The loan term for working capital is one year, with an interest rate of 5 percent per annum. For fixed capital loans, the term is three years, which includes a one-year grace period, followed by a two-year repayment period with four installments due every six months.

Oil mill entrepreneurs interested in applying for loans can do so at any of the following locations: all Oil Mill Owners Association offices throughout the Union Territory, Nay Pyi Taw, Region/State; all Oil Merchants and Oil Entrepreneurs Association offices; all branches of the Department of Industrial Supervision and Inspection; all branches of the Myanmar Economic Bank. Loan application forms can be obtained at any branch of the Myanmar Agricultural Development Bank.

#SAC #Oil Mill #MADB #mtnewsupdate